Govt justifies higher taxes on petrol and diesel

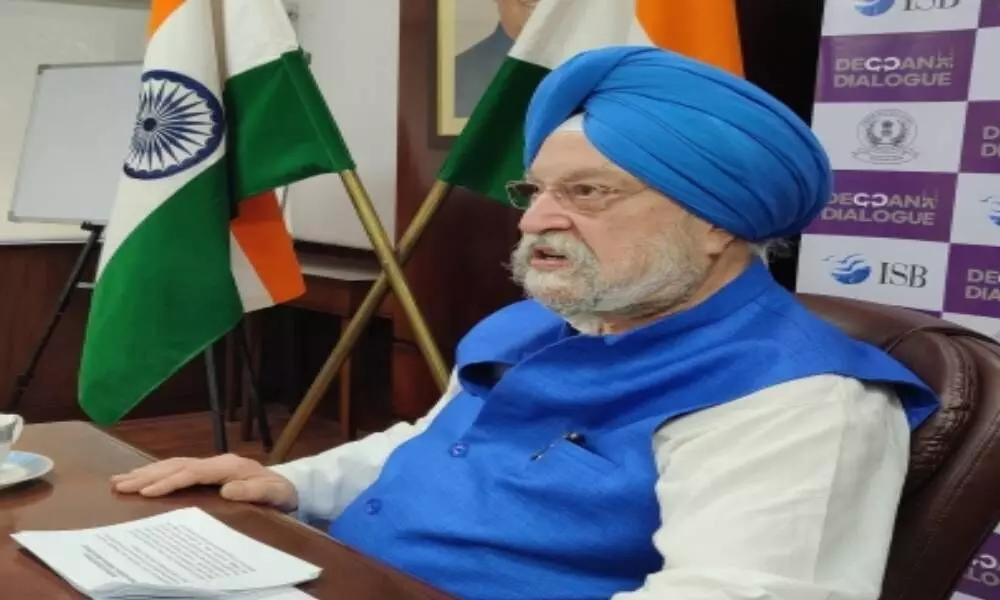

image for illustrative purpose

New Delhi, July 26 The government has justified high level of taxation on auto fuels suggesting that revenue from petroleum sector is important for running various developmental schemes but has refused to acknowledge the role played by higher prices of petrol and diesel in fuelling inflationary pressure on the economy.

Replying to a question on impact of rising fuel prices on country's economic recovery from the Covid-19 pandemic in the Lok Sabha, minister of petroleum and natural gas Hardeep Singh Puri said that revenue generated by taxation (on petroleum products) is used in various developmental schemes of the Government like Pradhan Mantri Gram Sadak Yojana (PMGSY), Pradhan Mantri Ujjawala Yojana (PMUY), Ayushman Bharat, Pradhan Mantri Garib Kalyan Yojana (PMGKY) and also to provide relief to the poor during the pandemic by schemes like Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY) under which free ration was provided to 80 crore beneficiaries during April, 2020 to November 2020 and May-June 2021, free vaccination against Covid-19 etc.

He said that over the last 7 years, length of National Highways has gone up by 50 per cent from 91,287 km (as of April 2014) to 1,37,625 km (as on 20 March 2021). Highway construction per day in India increased almost 3 times from 12 km/day in 2014-15 to 33.7 km/day in 2020-21. So, the minister said cess is used for infrastructure development and also generates employment.

Regarding higher prices of fuel raising inflationary pressure on the economy, the minister in his reply said that the weightage of petrol, diesel and LPG in the WPI index is 1.60 per cent, 3.10 per cent and 0.64 per cent indicating that petroleum products may not be responsible rising prices in other categories.

Taxes both by the Centre and the States account for a lion's share of current retail price of petrol and diesel. The Central Government levies Excise/Cess on Petrol of Rs 32.90/litre which includes Basic Excise Duty of Rs 1.40, Road & Infrastructure Development Cess of Rs 18, Agriculture and Infrastructure Development Cess of Rs 2.50 and Special Additional Excise Duty of Rs 11.

The current Central Excise/Cess on Diesel is Rs 31.80 per litre which includes Basic Excise Duty of Rs 1.80, Road & Infrastructure Development Cess of Rs 18, Agriculture and Infrastructure Development Cess of Rs 4 and Special Additional Excise Duty of Rs 8.

The total excise duty/cess incidence as percentage of retail selling on petrol and diesel is 32.4 per cent and 35.4 per cent respectively, as on July 16, 2021.

Besides, the State Governments levy VAT on the total amount of base price & Central Taxes of petrol & diesel which vary from Rs 4.83 in Andaman & Nicobar Islands to Rs 29.55 in Maharashtra, Rs 29.88 in Rajasthan, Rs 31.55 in Madhya Pradesh for petrol and Rs 4.74 in Andaman & Nicobar Islands to Rs 21.82 in Rajasthan for diesel, as on July 22, 2021.

The current retail price of petrol and diesel is hovering around Rs 101.54 a litre and Rs 89.87 a litre in Delhi. The retail prices have increased 41 times since May 1 this year taking up petrol prices by Rs 11.44 per litre in the national capital. Similarly, diesel price has increased by Rs 9.14 per litre in the national capital.

Since April 2020, petrol prices have increased by Rs 32.25 per litre from Rs 69.59 a litre to Rs 101.84 a litre now in Delhi. Similarly, diesel prices during the period has increased by Rs 27.58 per litre from Rs 62.29 to Rs 89.87 a litre in the national capital.

The minister in his reply also informed that after the country wide lockdown imposed on March 25, 2020, the consumption of petrol and diesel dropped to 20,068 TMT (thousand metric tonne) during April-June 2020 which was approximately 34 per cent less than the consumption of the same period (30,399 TMT) during previous year (2019).

As the lockdown was progressively lifted and economic activities resumed, the consumption of petrol and diesel gradually increased, reaching 28,410 TMT during January-March, 2021, which was approximately 106 per cent of the consumption during the same period in 2019.

Further, the consumption dropped with the restrictions imposed during the second wave of Covid-19 in April-May, 2021, only to pick up again. By July 21, 2021, the petrol sales in July were 118.65 per cent of the sales in the same time period in 2020, whereas they were 111.90 per cent of the July 2020 sales for diesel.